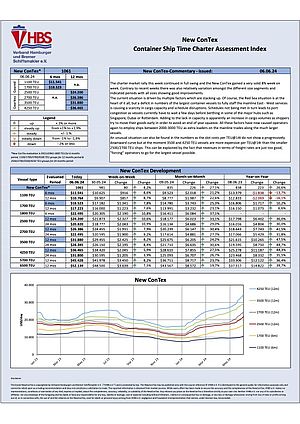

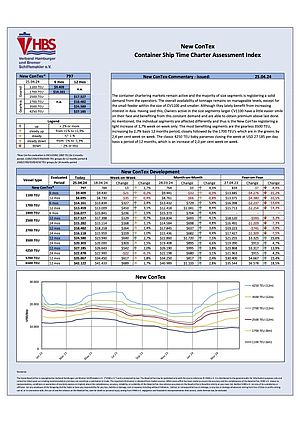

New ConTex - all rates in USD($)

|

|

New Contex | Additional Information | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 6 months | 12 months | 24 months | 12 months | 6 months | ||||||||||||

| date | Type 1100 | Type 1700 | Type 2500 | Type 2700 | Type 3500 | Type 4250 | ConTex | Type 2500 | Type 2700 | Type 3500 | Type 4250 | Type 5700 | Type 6500 | Type 1100 | Type 1700 | Type 1800 |

| 17.10.2024 | 14.182 | 22.859 | 28.418 | 30.736 | 38.380 | 48.495 | 1297 | 24.536 | 26.391 | 31.725 | 39.478 | 58.289 | 65.372 | 13.364 | 19.836 | 26.809 |

| 15.10.2024 | 13.986 | 22.977 | 28.127 | 30.509 | 37.815 | 47.225 | 1282 | 24.532 | 26.282 | 31.175 | 38.545 | 57.961 | 64.939 | 13.114 | 19.850 | 26.891 |

read disclaimer